31+ can someone co sign a mortgage

If you have a friend or family member who really wants a house but doesnt qualify. Ad Check How Much Home Loan You Can Afford.

Printable Monthly Budget Template 31 Excel Pdf Documents Download

Technically anyone is eligible to be a co-signer but to be approved by the mortgage lender a co-signer must be financially fit.

. Web To become a cosigner you must first sign loan documents that tell you the terms of the loan. The co-signer is required to pay back the loan if the borrower doesnt and suffers negative credit. Then you cosign on someone elses mortgage at 1500 per month.

Web Your signature as a co-signer on a mortgage note means you agree to pay off the loan or take over the payments if the borrower stops paying. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. This can be a big responsibility if. Other Underwriting Guidelines You may qualify for another mortgage if.

Web A co-signer may not help if you have truly bad credit. If your monthly gross income is 10000 and your current mortgage is 3000 per month your DTI is 30 assuming no other debts counting toward your DTI. Use Our Tool To Find Out If You Qualify.

If a co-signer has bad. Ad Check How Much Home Loan You Can Afford. The lender also must give you a document called the Notice to.

Lower credit score requirements. Web Can Cosigning A Mortgage Impact Your Credit. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

A co-borrower on the other hand is someone whos equally liable for each payment ie. Web PROS Pros of Co-signing a Mortgage. When evaluating a mortgage application by two people lenders often base their decision on the lowest credit score of.

Web A co-signer shares the responsibility for payment of a loan. One common expense most people dont consider when co-signing is excise tax. Web Lenders require that anyone on the loan must also be on the title to the home so a co-signer will be considered an owner of the home.

Web DTI is one of the most important factors when applying for any kind of credit or loan. Web A co-signer is someone who agrees to be a backup for the loan payments. Web Who can co-sign a mortgage.

If youre considering cosigning your main motivation should be helping someone buy a home. Web Before you sign weigh the outcomes of your relationship with the primary signer if the arrangement went south to make sure it is entirely worth it. Web Cosigning a mortgage involves taking on a lot of risk with little financial upside.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. If borrowers take title as. Web Essentially the co-signer props up the borrowing power of the primary borrower to reduce the risk to the lender and secure a mortgage.

Ad Calculate Your Payment with 0 Down. Web The co-signer is part owner of the home and the lender will hold the co-signer responsible if the primary borrower cant make their monthly mortgage payments. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Another thing to protect yourself against is any unforeseen expenses. Co-signing a mortgage can affect your credit score if payments arent made as both your credit.

Web Generally a DTI must fall within the mortgage underwriting guidelines of around 31 to 43 percent to qualify for a loan. Use Our Tool To Find Out If You Qualify. Web Theres no legal limit as to how many names can be on a single home loan but getting a bank or mortgage lender to accept a loan with multiple borrowers might be.

Web Whether youre the one buying a house or the one co-signing for someone else once theres a contract on the home you and the co-signer will complete an official application.

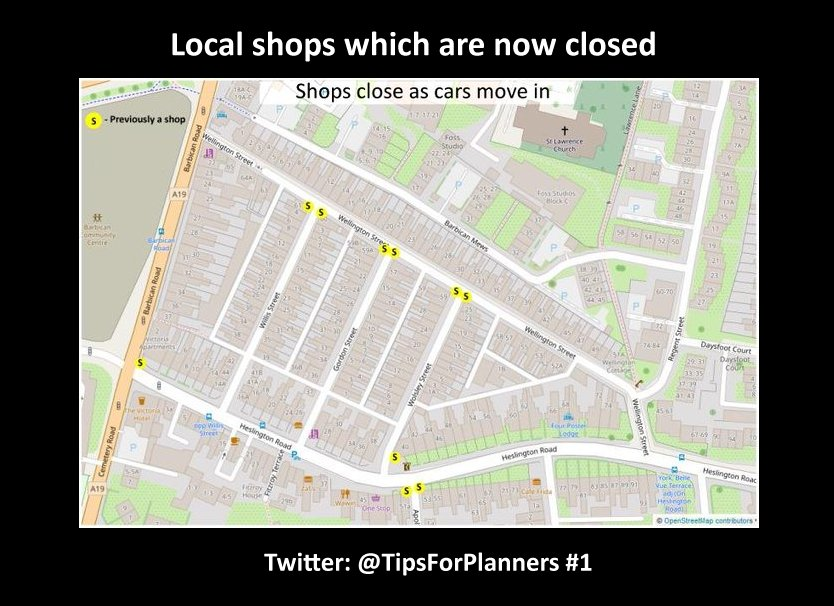

Car Free Development Lessens Inequality Ideas From Brussels And York Brussels Blog

I07vayykj3dm2m

Lbcer8kex992 2020q4

Co Signing A Mortgage How It Works Requirements Pros And Cons

31 Loan Agreement Templates Word Pdf Pages

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1915 Session I Education Higher Education In Continuation Of

31 Loan Agreement Templates Word Pdf Pages

Co Signer Rights What You Need To Know Bankrate

1980 County Road 3040 Bonham Tx 75418 Zillow

Low Income Student Loans Financial Aid Options Sofi

Mortgage Co Borrowers Vs Co Signers The Reasons Risks

Cosigning A Mortgage Pros Cons Faqs

Would A Co Signer Enable You To Qualify For A Mortgage

31 Acres Fm 2966 Quitman Tx 75783 Realtor Com

31a Pine Creek Rd L1 Troy Mt 59935 Realtor Com

Free 31 Example Of Reference Letter Samples In Ms Word Pdf

How Mortgage Co Signing Works Howstuffworks

Komentar

Posting Komentar